Pay off your mortgage quicker and enjoy homeownership sooner

Check Out Our Google Reviews

At Credit Star, we make home financing easier with personalized, transparent solutions that put your needs first.

With access to 33 lenders, including the big four, we secure competitive rates tailored to your financial goals—without the hidden fees.

Our experienced brokers handle everything—paperwork, lender negotiations, and more—so you can focus on what matters most. Less stress, more results.

No matter your financial goals, we match you with the perfect loan from our wide range of options, designed specifically for your needs.

We work closely with conveyancers and agents to streamline the process, saving you valuable time while securing the property you desire.

We’ve cut down the time, reduced the paperwork, and eliminated the hassle.

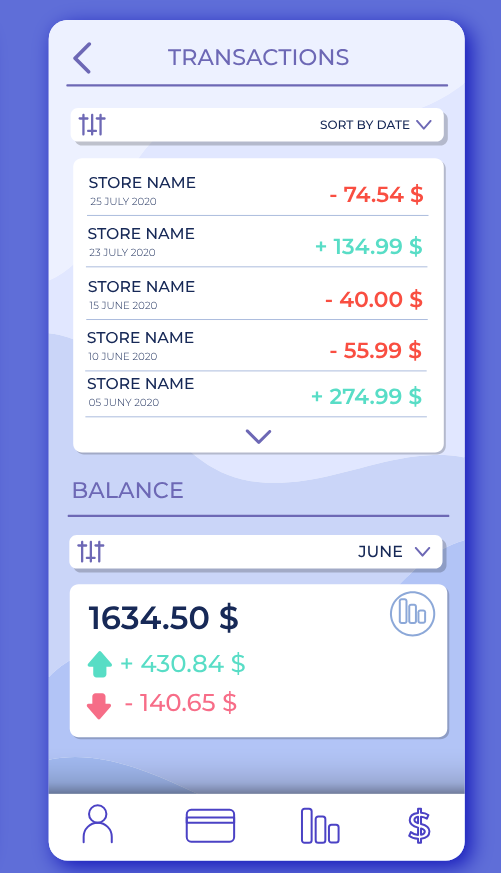

Estimate your repayments, explore tailored loan options, and check your eligibility—all in just 3 minutes. It’s fast, easy, and requires no credit checks, so you can get started right away with confidence.

Our quick and easy 15-minute online application process is designed to save you time, delivering a decision in as little as 60 seconds. No unnecessary steps, just fast and straightforward results, so you can move forward with confidence.

Once you’re approved, review and sign your documents. We’ll handle the rest to ensure a quick and seamless settlement, so you can move forward and secure your new home as fast as possible.

Our Aussie-based Loan Experts are ready to assist you with any questions. They’re here to guide you through the process or even complete the application with you.

Join the many satisfied customers of Credit Star and read their experiences on Google Reviews.

EXCELLENTTrustindex verifies that the original source of the review is Google. I wish we could give more than 5 stars!! Harbir and his team were awesome from the start to the end of the house buying process!!! We are so grateful for their clear advice and how responsive they were to our millions of questions. Navigating a home loan is usually pretty awful and time consuming. Harbir explained every step clearly and has fabulous online processes so we could submit all documentation easily. His team are friendly, professional and very, very good at explaining things to busy, time-poor people. We felt secure in every decision we made along the way and we are now very happily settled into our new home and feeling great about the purchase. We cannot recommend Harbir and his team more highly if you want someone to really partner with you in the house buying process. Thanks Harbir - we are so grateful for your support!!!Posted onTrustindex verifies that the original source of the review is Google. Great Experience with Credit Star! Harbir provided outstanding assistance throughout the entire process. He addressed all our queries with clarity and professionalism. His approach was neat, well-structured, and ensured we fully understood everything. Truly appreciate the excellent support!Posted onTrustindex verifies that the original source of the review is Google. I had the pleasure of working with Harbir Hundal from Credit Star Home Co Loans, and I couldn’t be more grateful for his help in securing my first home loan. From start to finish, Harbir was incredibly professional and knowledgeable. He took the time to explain the entire process in detail, which made everything so much easier to understand. Not only did he walk me through every step of the loan application, but he also introduced me to a fantastic property consultant, which was a huge bonus. Harbir took care of all the paperwork for the FHG approval, ensuring everything was in order and smoothly processed. Thanks to his expertise and dedication, I was able to secure my loan and move into my new home with confidence. I highly recommend Credit Star Home Co Loans - Harbir Hundal for anyone looking for expert loan assistance!Posted onTrustindex verifies that the original source of the review is Google. Huge Thanks to Harbir and team credit Star. Once Again you guys have deliver it. I need to refinance my loan and was in doubt what to do, Harbir was one call away and happy to assist again with the same attitude and smile. Team credit Stars, You guys are my Stars. Highly recommended , If someone looking for finance advice, Please reach out to credit star teamPosted onTrustindex verifies that the original source of the review is Google. I only have positive things to say about the professionals at Credit Star Co Home Loans. Guided us step by step throughout the process of purchasing our home. Harbir is very knowledgeable and experienced, from home loan application to working with banks to get you the right loan and interest rate was smoothly handled. Guys at Credit Star Co Home Loans are 10 out of 10.Posted onTrustindex verifies that the original source of the review is Google. Mr. Harbir provided an outstanding assistance in securing the best mortgage deal for us. He connected us with the most suitable bank and ensured everything was completed on time. His helpfulness and professionalism were evident throughout the entire process. With diligent follow-ups and meticulous attention to detail, Harbir handled every aspect of our mortgage application seamlessly. Thanks to his dedication and the hard work of his team, we are now happily settled in our new home. We highly recommend Harbir to anyone seeking a dedicated and efficient service.Posted onTrustindex verifies that the original source of the review is Google. It was great working through my slightly complex mortgage application for multiple mortgages with Harvie and Credit Star. I couldn't have asked for a more patient and professional broker supported by a very capable team. Harbir was able to get me approval at a time I had given up on traditional lenders and other brokers. While the higher interest rate that I accepted was not fun, it was definitely a trade-off I was willing to make to keep my investment property. Harbir was the only one able to get me a satisfactory outcome (in raw words get me approved) when two other brokers and traditional lenders couldn't. I would recommend Harbir and Credit Star to anyone looking for a decent and capable broker, especially those with complex financial standing. Thanks Harbir!!Posted onTrustindex verifies that the original source of the review is Google. Harbir and his team helped me through the process of buying my first home!! They worked absolute miracles and made the process extremely smooth. Buying your first property can be extremely daunting and for me came with so many unknowns!! But throughout it was always made sure that I had a clear understanding of what the process was, and I never felt left in the dark. Once I had settled in my home they continued to check in on me and have helped me through many other processes, ie new interest rates. I will forever be recommending Harbir and his staff to everyone wanting to purchase or refinance a propertyPosted onTrustindex verifies that the original source of the review is Google. Harbir and his team have been there for us through the entirety of our journey finding a place we can call home. He's been diligent, approachable and accommodating in helping us understand and navigate the murky waters of the financing world. Our many thanks to Harbir and the team at Credit Star for helping us lock in our dream home!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

CREDIT REPRESENTATIVE 506564

BLSSA Pty Ltd ACN 117 651 760 (Australian Credit Licence 391237)

Have questions or need help with your application? Our Aussie Loan Experts are ready to assist.

Weekdays 9am – 5pm AET

With AcceleRATES, we’ll reduce your rate as you pay down your Straight Up or Power Up home loan.

At Credit Star, we ensure both new and existing customers enjoy the same competitive rates for comparable loans with our Automatic Rate Match.

Our Straight Up and Power Up loans come with absolutely no Credit Star fees!